Pakistan’s economy is bleeding out from rampant tax evasion, costing the government nearly 1 trillion rupees annually in lost revenue. This staggering figure, highlighted in recent Pakistani media reports, underscores a systemic failure that’s dragging the nation deeper into financial distress.

The real estate sector alone siphons off about 500 billion rupees each year through underreporting and dodgy valuations. Add to that 310 billion rupees from the illicit tobacco trade, and it’s clear why Pakistan’s fiscal house is crumbling. Consumer goods industries operate largely off the books, evading documentation and oversight entirely.

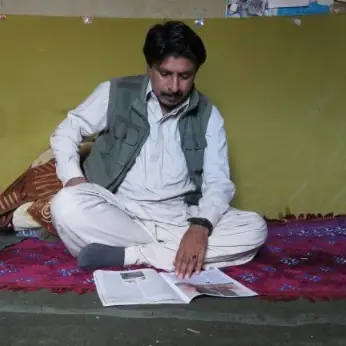

A detailed analysis in Karachi’s Business Recorder points the finger at regulatory agencies’ complicity. Without their protection, this shadow economy would collapse under minimal enforcement pressure. The Federal Board of Revenue (FBR) posted a 545 billion rupee deficit in the first half of the fiscal year – not just from sluggish growth, but deliberate exclusion of value creation from the tax net.

Instead of dismantling evasion networks, authorities pile more taxes on honest payers: salaried workers, registered businesses, and formal companies. This unfair burden stifles investment, erodes incentives, and pushes marginal operators back into informality, creating a vicious cycle where honesty is punished and cheating rewarded.

Research from Ipsos reveals deep-rooted chaos across sectors. Real estate thrives on low valuations and selective probes, while illegal tobacco flourishes despite strong networks. Similar issues plague tires, lubricants, pharmaceuticals, and tea industries.

Solutions like targeted enforcement, proper documentation, reliable valuations, and track-and-trace systems are often discussed but lack political will. Confronting the undocumented economy means challenging powerful elites – a task successive governments have dodged by shielding enforcement agencies from interference.

Pakistan’s path to recovery demands bold reforms to plug these leaks and foster a fair tax system that rewards compliance over corruption.