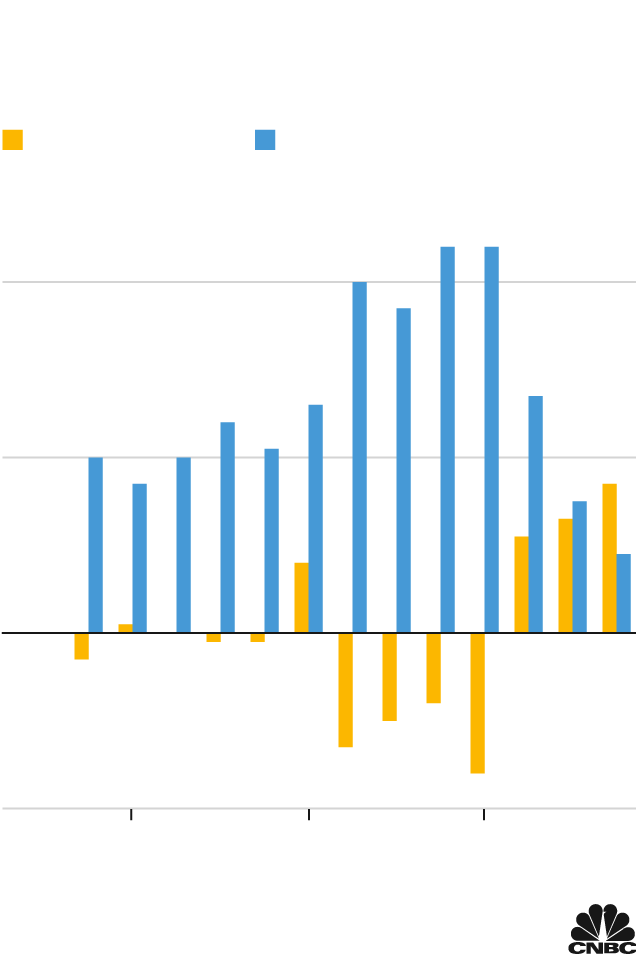

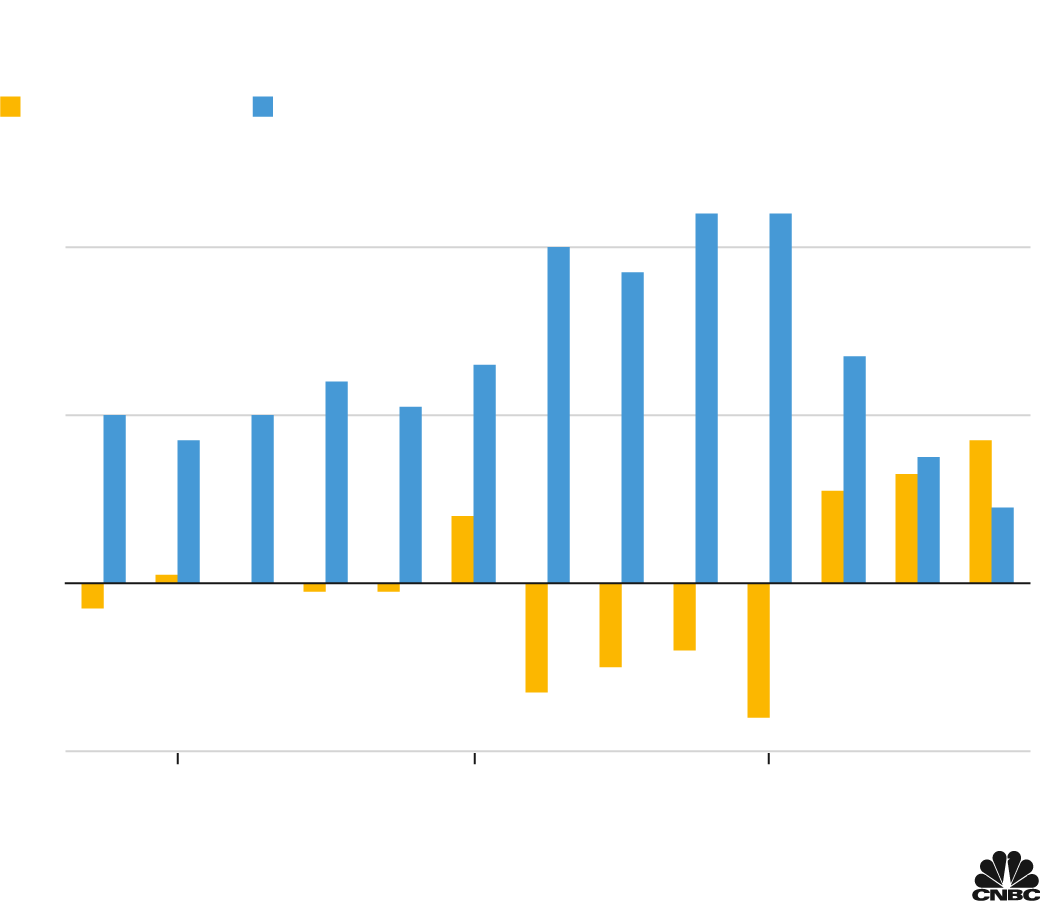

Recently not up to 1% of unpolluted produce is grown thru hydroponics programs as opposed to open-field agriculture, however this section is forecast via Mordor Intelligence to develop via just about 11,% or about $600 million, via 2025.

5th Season

Subsequent to the closing metal mill within the deficient business the town of Braddock alongside the Monongahela River simply 9 miles from Pittsburgh’s U.S. Metal Tower, a vertical farming trade subsidized via billionaire Nicholas Pritzker’s Tao Capital is sprouting as an agritech innovator.

The beginning-up, based in 2016 as RoBotany via MBA pupil Austin Webb and incubated at Carnegie Mellon College, is aiming to disrupt the $60 billion U.S. produce marketplace. Now named the extra consumer-friendly sounding 5th Season, the rising trade is leveraging complicated era, $75 million in challenge capital, greater distribution, a deliberate new Columbus, Ohio, facility, and an expanded control group to attain within the fast-growth vertical farming marketplace. CEO Webb expectantly tasks 5th Season generally is a $15 million trade in Pittsburgh inside 5 years and $500 million thru geographic growth plans, and estimates gross sales will hit a double-digit income price this 12 months and a 600% income build up.

“Our sensible production facility improves the yield, style and texture of the greens, and does that with 95% much less water, 95% much less land, and makes use of no insecticides or chemical compounds,” mentioned Webb, who’s 33. 5th Season’s computerized proprietary device grows recent produce year-round indoors in vertical trays, depending on synthetic intelligence, robotics and knowledge to keep watch over gentle, water and vitamins, and harvest leafy vegetables.

Hydroponics is rising temporarily as meals supply

Recently not up to 1% of unpolluted produce is grown thru hydroponics programs as opposed to open-field agriculture, however this section is forecast via Mordor Intelligence to develop via just about 11% once a year to about $600 million via 2025. “There is super runway as the associated fee comes down and extra dependable operations take away the danger,” mentioned Brian Holland, managing director of Cowen & Co. in New York. “It is a race to scale with doubtlessly a couple of winners who can turn out the industrial style for automated, robot rising,” he added. “5th Season is extra complicated, if no longer probably the most complicated, out there in marrying era and robotics to develop greens indoors at a cheaper price.”

5th Season is competing in a capital in depth, extremely fragmented marketplace with greater than 2,000, most commonly smaller farms and a handful of bigger scale gamers. A number of the biggest is San Francisco-based Lots Limitless, which not too long ago inked $400 million in strategic investment from Walmart and plans to promote its recent produce from its Compton facility on the store’s California retail outlets. Any other main rival is AeroFarms in Newark, New Jersey, which scrapped a SPAC deal to move public in October 2021 and is constant to construct out capability at a Danville, Virginia farm.

“Marketplace management is only a serve as of time and a serve as of capital,” mentioned Webb.

Racing to construct out its trade and stay tempo with competition, 5th Season plans to build its 2nd indoor rising farm in 2023, and is negotiating for a land parcel in Columbus, Ohio, close to the John Glenn Airport. Thru a partnership with hummus maker Sabra in December 2021, the corporate additionally has offered a brand new product line of co-branded, grasp ‘n pass salad kits, priced at $6 to $8. Distribution of its merchandise are being expanded this March at extra Large Eagle shops in addition to Kroger and ShopRite throughout 10 states and 1,000 places, with a objective of achieving 3,000 grocery retail outlets in 2023. In its preliminary 12 months of business operation in 2000, some 500,000 kilos of its produce had been equipped to close by eating places and campus eating places from its 60,000-square foot rising area on a half-acre of land.

Extra from CNBC’s Small Industry PlaybookA new Rust Belt increase

5th Season’s progress spurt alerts a brand new high-tech technology for the previous steel-making capital. Dozens of regional tech start-ups are rising in Pittsburgh and all the way through the previous Rust Belt as blue-collar manufacturing unit employee transitions to technical jobs and older, business cities are rebooted.

“The tech multiplier does not raise all boats however it’s spreading within the heartland,” mentioned Congressman Ro Khanna of Silicon Valley, creator of “Dignity In A Virtual Age.”

“The manufacturing unit staff and technicians understand how to make issues and feature an ordinary paintings ethnic and sense of group. They’re defying previous conventions,” he mentioned.

Gearing up, 5th Season expanded its management group in January, whilst worker depend is anticipated to extend to 100 subsequent 12 months from 80 now. Finance and tech veteran Brian Griffiths got here on board as CFO from semiconductor corporate Skorpios Applied sciences with revel in at Credit score Suisse and Guggenheim Companions. Varun Khanna used to be employed as vp of meals merchandise from management posts at Chobani and Sabra. Glenn Wells joined as senior vice provide of gross sales and in the past labored at Quaker Oats, Welch’s and Dole.

Any other prong in its progress technique is a deliberate $70 million expenditure on a brand new Columbus vertical farm this is thrice higher than the $27 million Braddock plant, together with actual property construction for land, a development and gear. The corporate’s extremely computerized farms most effective require 35 to 50 manufacturing staff. The Pittsburgh plant makes 4 million salad foods once a year, whilst the bigger central Ohio location is anticipated to provide 15 million. 5th Season is operating with financial construction teams One Columbus and Jobs Ohio at the new location.

The Carnegie Mellon connection

The root for 5th Season’s game-changing trade comes from the highbrow energy at Carnegie Mellon College and Pittsburgh’s tech entrepreneurial cluster in laptop science, robotics and engineering. Webb evolved a prototype in his closing 12 months of the MBA program and introduced the trade upon commencement with co-founder Austin Lawrence, an environmental scientist and mechanical engineer he met on campus.

A 3rd co-founder, Webb’s brother Brac, is CTO. He designed the manufacturing tool. The device used to be stress-tested for 2 years in a transformed metal mill at the south aspect of Pittsburgh ahead of the Braddock farm began operations in 2020.

Webb used to be mentored via Dave Mawhinney, govt director of CMU’s Schwartz Heart for Entrepreneurship, who helped him hook up with traders and position fashions corresponding to serial entrepreneur Luis von Ahn, the Pittsburgh-based founding father of Nasdaq-listed edtech corporate Duolingo. He additionally offered MBA pupil, Grant Vandenbussche, a former Basic Turbines world technique coordinator, who joined the group in 2018 as a trade construction supervisor and is now leader class officer. “5th Season is a testomony to CMU’s talent to draw very proficient younger other folks and develop marketers thru its MBA program,” mentioned Mawhinney. “It is all concerning the community.”

5th Season CEO Austin Webb

5th Season

Even ahead of graduating in 2017, Webb coated up capital from angel traders, maximum of them hooked up to CMU. The community impact additionally performed out as Mawhinney offered Webb to the Columbus-based VC company Pressure Capital, which seeded the start-up with $1 million in 2017 and led a $35 million around in 2019 because it got here out of stealth mode, modified its title from RoBotany, and Pressure spouse Chris Olsen joined as a board member.

“Chris has driven us to be considerate concerning the marketplace and to assume larger nationally, no longer simply in the neighborhood or domestically, and to construct a long lasting corporate and a brand new product line,” mentioned Vandenbussche.

The $75 million it has raised so far from traders contains no longer most effective Pritzker’s Tao Capital Companions in San Francisco however 8 other investor teams that joined in all through 2021.

“Pittsburgh is coming in combination as an ecosystem. Some of the causes it is doubling down is on account of its strengths in AI, gadget studying and legacy with biosciences,” mentioned Equipment Mueller, who heads group networking workforce RustBuilt and not too long ago turned into vp of crypto asset corporate Stronghold Virtual Mining in Pittsburgh.

Not depending on metal, iron, and its rivers as aggressive benefits, the town is transitioning from gritty industries and robotics start-ups are crowding into the so-called Silicon Strip of former warehouses. This mid-sized town of 303,000, not up to 1/2 its height inhabitants of 677,000 in 1950, has emerged as a era testbed for self-driving era from Ford-invested Argo AI and Amazon-backed Aurora, and Uber’s era unit obtained via Aurora. It is usually an anchor for R&D labs at Fb, Apple, Google, Zoom, and Intel.

A lingering factor dealing with Midwestern start-ups is a scarcity a raffle capital. California, New York and Boston logged about two-thirds of $329.9 billion in start-up investments in 2021. This imbalance is starting to shift towards specialised inland hubs as strongholds take form corresponding to Pittsburgh with robotics in addition to Cleveland with biotech and Indianapolis with SaaS.

Progressed way of life facilities, greater alternatives and the decrease prices of dwelling are attracts for millennial tech skill to inland hubs. The co-founders of 5th Season, and lots of others, got here to Pittsburgh to pursue entrepreneurship and feature stayed.

“The one ones who do not like Pittsburgh are those that by no means got here right here and those that left however by no means got here again,” mentioned Lynsie Campbell, a serial founder who bounced round New York, Los Angeles, and San Francisco however returned house as a Pittsburgh-based spouse with The Fund Midwest, and is a pacesetter in town’s challenge capital and start-up sphere.

Zoom In IconArrows pointing outwards

To be told extra and to enroll in CNBC’s Small Industry Playbook match, click on right here.