On this Feb. 21, 2020 photograph, Dilip Kumar, vice chairman of bodily retail and generation for Amazon, poses for a photograph within an Amazon Pass Grocery shop set to open quickly in Seattle’s Capitol Hill community.

Ted S. Warren | AP

Amazon has spent nearly 3 a long time perfecting the artwork of bringing the whole lot conceivable to the doorstep within the shortest period of time, on the lowest conceivable value. Via nearly any measure, it is been one of the vital biggest company successes in historical past.

However in spite of Amazon’s unquestioned dominance in e-commerce, one massive marketplace has confirmed in particular vexing: groceries.

Amazon has offered a dizzying array of services and products — Top Now, Contemporary, Pass and others — in its effort to turn into a large within the $750 billion U.S. grocery marketplace. In 2017, it spent $13.7 billion to obtain Entire Meals, a ticket greater than 10 occasions greater than Amazon had paid in any prior deal.

Nonetheless, it is only a area of interest participant within the trade. As of mid-December, Amazon.com and Entire Meals accounted for a blended 2.4% of the grocery marketplace over the last three hundred and sixty five days, whilst Walmart managed 18%, in line with analysis company Numerator. Amazon’s supply services and products have struggled to face out in a crowded box, whilst the Pass automatic comfort shops were deprioritized, in line with folks acquainted with the corporate’s technique.

On founder Jeff Bezos’ watch, shareholders expressed little worry about this nook of the Amazon empire. The corporate’s inventory value soared nearly 400% in his final 5 years on the helm, boosted through e-commerce expansion and a booming cloud trade.

The tale has modified since July, when Bezos used to be succeeded as CEO through longtime cloud leader Andy Jassy. The inventory has dropped through about 13% in that point and used to be the worst performer within the Large Tech workforce final 12 months. Amazon simply reported its slowest expansion fee for any quarter since 2001.

That can give traders a explanation why to begin searching for issues they do not like. One house of scrutiny might be Amazon’s bodily shops unit, which contains Entire Meals and Contemporary shops. It noticed decrease gross sales in 2021 than in 2018, at the same time as its footprint of rentals expanded through 17% over that reach.

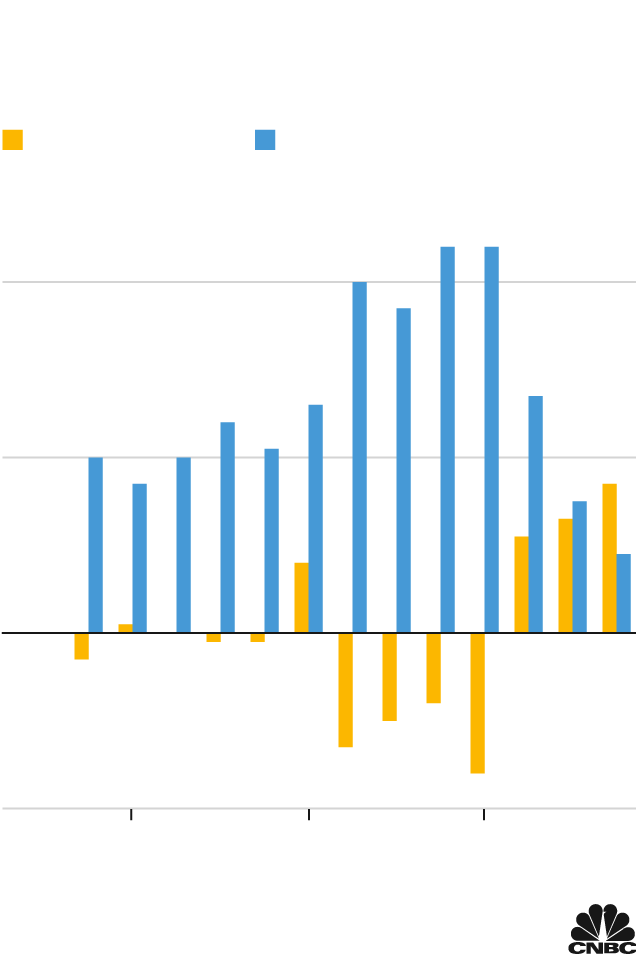

Amazon quarterly gross sales, exchange from prior 12 months

Supply: Corporate filings. As of This autumn 2021.

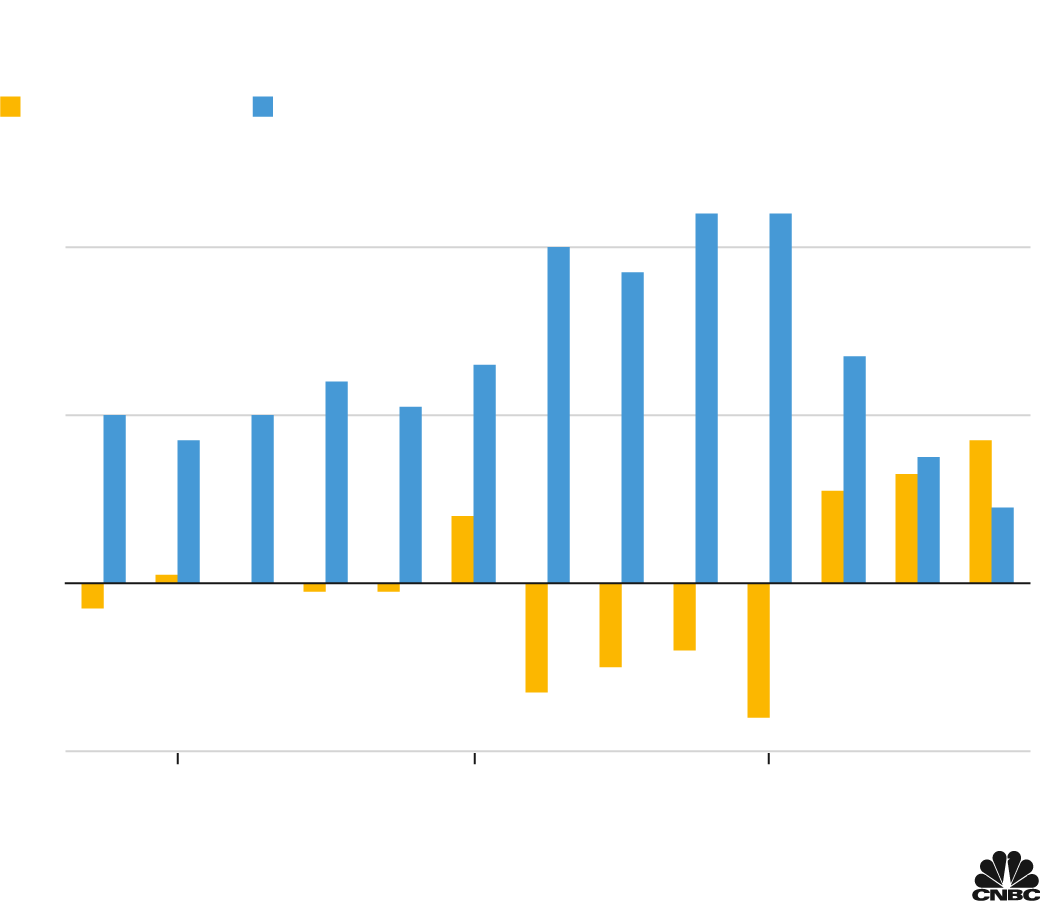

Amazon quarterly gross sales, exchange

from prior 12 months

Supply: Corporate filings. As of This autumn 2021.

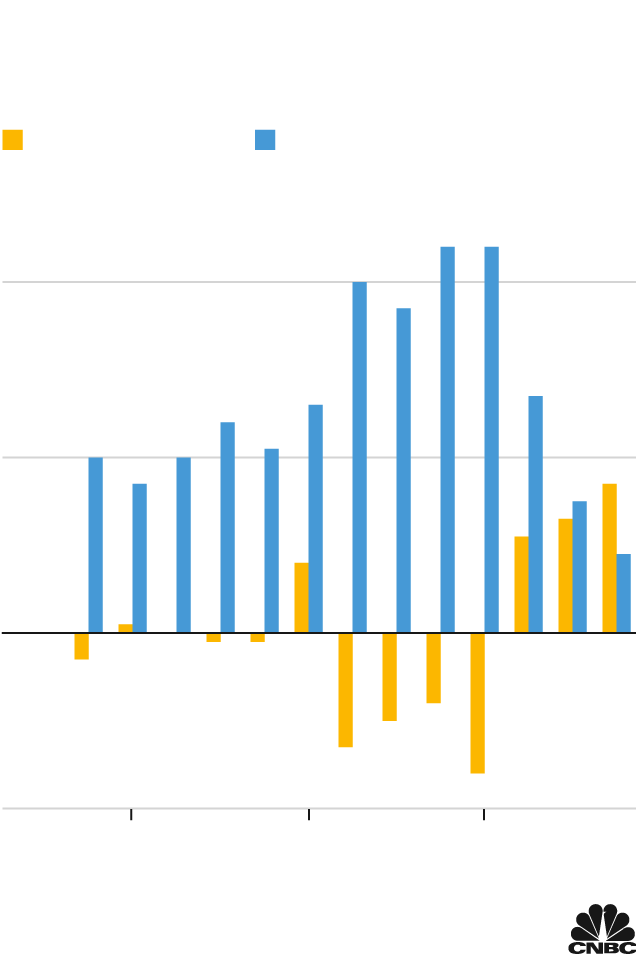

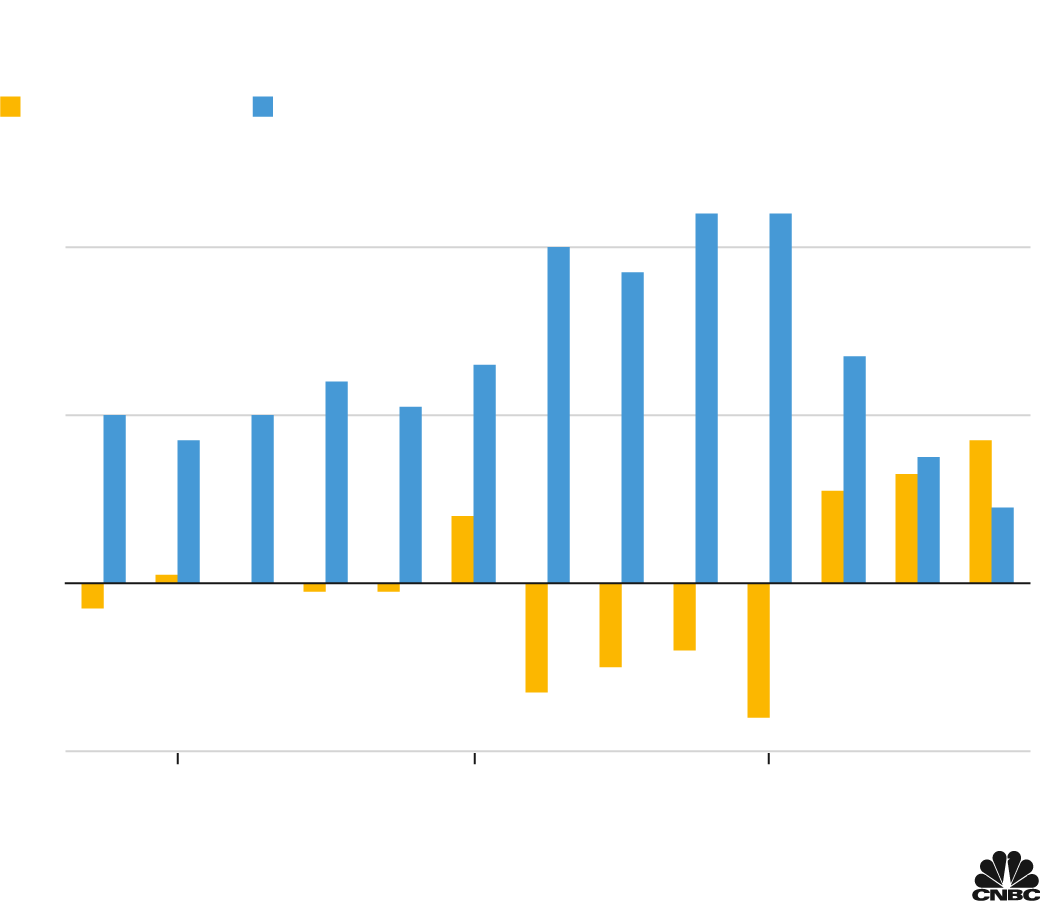

Amazon quarterly gross sales, exchange from prior 12 months

Supply: Corporate filings. As of This autumn 2021.

"Amazon's all concerning the cloud, e-commerce and leisure," stated Jake Dollarhide, CEO of Longbow Asset Control, which has counted Amazon has a "core maintaining" since 2011. "It is nearly just like the grocery trade is a pricey passion."

Festival is all over. Entrenched avid gamers similar to Walmart, Goal, Kroger and Albertsons are getting savvier with virtual choices, because of the pandemic jolt. In the meantime, Instacart, Uber, DoorDash and Gopuff are throwing cash at fast supply, Amazon's candy spot.

With Jassy now plotting the street forward for Amazon and its disjointed portfolio of high-cost grocery property, CNBC talked with insiders and previous staff about how the corporate were given thus far and the place it is going from right here.

Most people who agreed to be interviewed did so provided that they now not be named as a result of they were not approved to discuss their reports or they feared retribution from the corporate.

They portrayed an atmosphere of intense inner festival for sources and stated tradition clashes ensued when teams got here in combination. A part of this is intentional, as Bezos fostered a office of competing concepts. It is usually created chaos and a loss of transparent route.

Amazon declined to supply observation at the file for this tale or make any executives to be had for interviews.

Contemporary vs. Top Now

The 12 months 2017 marked an inflection level for Amazon's grocery technique.

Overdue that 12 months, two emerging stars at Amazon have been known as into a gathering to reconsider how the corporate delivers groceries.

Amazon used to be pouring cash into the Top Now speedy supply program and the Amazon Contemporary grocery supply carrier.

Bezos wasn't glad. He noticed Contemporary and Top Now as too very similar to justify the hefty funding that each and every required. That downside used to be amplified through the Entire Meals acquisition, which made Amazon's grand ambitions transparent to the contest and led traders to offload stocks of alternative grocery chains.

Amazon Contemporary grocery supply truck from the Amazon Top carrier parked on a suburban boulevard in San Ramon, California, July 5, 2018.

Smith Assortment/Gado | Archive Footage | Getty Photographs

Amazon management summoned Stephenie Landry, who ran Top Now, and Ben Hartman, head of Amazon Contemporary, to the corporate's Seattle headquarters. They have been instructed to organize for a "bake-off" that will resolve the trail ahead for the corporate's on-line grocery trade, in line with folks acquainted with the subject.

It used to be a pivotal second for Amazon. The Contemporary supply carrier were round since 2007, when longtime government Doug Herrington, a former vice chairman at dot-com grocery flameout Webvan, introduced an initiative to pressure recent end result, greens, meat and milk in temperature-controlled tote baggage to a couple citizens within the Seattle suburb of Mercer Island.

Andrea Leigh recalls the early days of the grind, looking to make it within the low-margin trade. Having labored in Amazon's media, grocery and gourmand and child classes, Leigh used to be on maternity depart in 2010 when she used to be introduced again to assist Contemporary generate profits so it would develop past Seattle.

"We were operating on Contemporary for 3 years at that time and we hadn't gotten the style successful," Leigh stated. "There used to be an actual pastime and need to enlarge."

One thought used to be to persuade grocery consumers towards higher-priced pieces in different classes. It can be a pair of headphones or a last-minute birthday reward.

Leigh constructed an set of rules that recognized top-selling pieces in Seattle, considering it would make stronger Contemporary's normal products collection. The tool did not all the time paintings as meant.

One time Amazon ended up ordering a host of life-sized horsehead mask, after the set of rules flagged them as town's height toy. The set of rules did not alter to acknowledge that Halloween used to be coming near.

By the point Contemporary introduced out of doors Seattle, opening a Los Angeles operation in 2013, Top Now used to be at the horizon and would quickly pose a problem from the interior.

Contemporary were round for 6 years, however Top Now had a definite benefit. It used to be being run through Landry, who had served as a shadow consultant to Jeff Wilke, Bezos' right-hand guy. She used to be handpicked for Top Now through Dave Clark, the highest retail boss, after she created a club program aimed at expectant moms that inspired management.

Top Now used to be additionally unprofitable, however the crew proved it would make deliveries with expanding potency, and Amazon executives have been assured it would scale, two former Top Now staff stated.

Via 2016, Top Now used to be to be had in dozens of towns around the nation, and used to be coming into Contemporary's turf, including recent meals to its supply choices and going past Goal-like merchandise similar to shampoo and paper towels, a former Top Now worker stated.

Two former staff described it as a company contention, and discussions started about whether or not the teams will have to proceed alongside their separate tactics.

With Top Now and Contemporary each short of proceeding capital and Entire Meals all of sudden added to the combo, the bake-off ensued between Landry and Hartman.

Landry's facet received. Top Now, which used to be simply 3 years previous on the time, took over regulate of Contemporary. Hartman, who began at Amazon as a product supervisor in 2002, left groceries for a job within the Ecu client trade.

Stephenie Landry, VP of grocery at Amazon, poses in a stacking isle full of orders from shoppers making final minute vacation purchases, Wednesday Dec. 21, 2016, at a distribution hub in New York.

Bebeto Matthews | AP

Landry, who retained the name vice chairman of grocery, saved the Contemporary branding as it gave the impression to resonate higher with shoppers than Top Now, in line with folks with wisdom of the subject. Contemporary used to be obviously related to groceries, whilst Top Now might be simply perplexed with Amazon's Top subscription carrier.

Amazon discontinued the Top Now app and website online final 12 months, bringing all on-line grocery orders underneath Contemporary or Entire Meals.

The contention remained because the blended groups struggled to paintings in combination. One former Top Now worker stated the Contemporary crew used to be demoralized and unsatisfied about being introduced underneath Landry's management.

Meshing Amazon's on-line and in-person technique is proving to be a fair larger problem.

The upscale grocery gamble

Previous to 2017, Amazon had already moved into brick-and-mortar retail with bookstores and pop-up mall kiosks, however Entire Meals used to be its first actual foray into devoted grocery shops.

Entire Meals additionally represented a chance for Amazon to exhibit its merchandise and generation, growing the most productive mix of e-commerce and in-person buying groceries. It sounded nice in principle. In observe, Amazon confronted main cultural and integration demanding situations.

Based in 1980 in Austin, Texas, Entire Meals grew up a universe clear of the tech hubs of Seattle and Silicon Valley. The corporate relished the native revel in. Regional managers had a degree of autonomy over their shops, all the way down to the artists they employed let's say chalkboard indicators, in line with a former Entire Meals senior supervisor.

Amazon had its personal concepts. In an instant after the deal closed, it serious about including Top Now could be fast deliveries to the Entire Meals menu to succeed in a brand new set of consumers.

Top Now ultimately made it into Entire Meals shops national. However alongside the best way, Amazon came upon the shop layouts made it tricky to successfully select and procedure orders, a former Top Now worker stated.

Workers get ready orders for transport at Amazon.com Inc.'s Amazon Top Now achievement heart in Singapore, on Thursday, July 27, 2017.

Ore Huiying | Bloomberg | Getty Photographs

So fairly than depending on Entire Meals, Amazon explored growing a brand new grocery chain that blended courses from Entire Meals with Amazon's logistics experience, actual property footprint and Top Now warehouses, which positioned restricted stock with reference to shoppers.

Steve Kessel, an established Amazon government who had constructed the unique Kindle earlier than taking on bodily shops, conceived of a grocery store the place grocery supply and pickup did not intrude with in-store buying groceries. Customers may talk over with the shop and nonetheless be thrilled, whilst sections of the power can be devoted to deliveries and curbside pickup.

Kessel selected Jeff Helbling, a former Kindle vice chairman, to guide what would turn into Amazon Contemporary shops.

In 2020, the primary Amazon Contemporary opened within the upscale Los Angeles community of Forest Hills. It featured a mixture of grocery store staples and ready meals, in addition to meats and seafood. In a separate house, shoppers may go back Amazon orders or purchase Hearth capsules.

Amazon Contemporary supermarkets now quantity greater than 20 throughout six states and Washington, D.C. Many are in structures previously occupied through regional supermarkets, similar to Fairway Marketplace and Massive Meals.

In lower than two years, the shops have already confirmed they are able to be a lot more environment friendly than their opponents within the trade.

A kind of 35,000-square-foot grocery store most often can satisfy a median of 120 to 150 on-line orders an afternoon. Jordan Berke, CEO of The next day Retail Consulting, stated Amazon Contemporary shops are in a position to dealing with order quantity that is 3 to 5 occasions greater on the time of release. He stated the ones figures are according to discussions with corporate staff.

Along with the really helpful shop design, Berke stated that Contemporary shops additionally see extra on-line call for as a result of the Top subscriber base.

They look like successful with shoppers. Site visitors at 8 Contemporary shops remained constant between March, across the time they opened, and September, in line with a document printed in October through retail analytics company Placer.ai.

"The relative balance in visits presentations {that a} core workforce of consumers have added a go back and forth to Amazon Contemporary to their common grocery regimen, indicating that Amazon Contemporary has effectively built-in into the grocery combine for the neighborhoods it entered," the company wrote.

However management has been in flux. Kessel introduced his departure in past due 2019, a transfer that used to be seen as a big shakeup, folks acquainted with the subject stated. Cameron Janes, who were vice chairman of bodily retail, left in November.

Amazon did not formally exchange Kessel till this month, when Tony Hoggett, a veteran of British grocery store chain Tesco, used to be introduced on to guide bodily shops. Hoggett's hiring used to be noticed as an acknowledgment through some staff that the corporate wanted extra brick-and-mortar revel in.

Landry reviews to Hoggett, an indication of Amazon's center of attention at the growth of bodily shops.

Pass shops now not a damage hit

Grocery shops and deliveries are all a part of what Amazon calls F3, or Contemporary Meals Rapid.

There is one piece of its grocery portfolio that is orphaned from that workforce: Amazon Pass.

In 2012, Kessel tapped two Amazon retail veterans, Gianna Puerini and Dilip Kumar, to spearhead a top-secret undertaking that will evolve into an effort to automate the benefit shop, eliminating the trouble of ready in traces.

Puerini and Kumar's crew evolved a cashier-free shop, full of cameras and sensors that use synthetic intelligence to spot and observe sandwiches, yogurt and chips picked off the cabinets.

The primary Amazon Pass opened to the general public in 2018 on the corporate's Seattle headquarters.

After greater than a 12 months in beta, Amazon opened their cashier-less grocery shop to the general public

Stephen Brashear | Getty Photographs

4 years later there are 24 shops, a fragment of the three,000 the corporate used to be having a look to open through 2021, in line with a Bloomberg document after the preliminary release.

They are closely concentrated in dense, city spaces, that are splendid places for busy place of job employees all through the lunchtime rush. But if workplaces closed their doorways all through the coronavirus pandemic and towns went into lockdown, visitors disappeared and Amazon tempered its growth efforts.

Closing month, the corporate introduced plans to open its first Pass shop within the suburbs, within the the town of Mill Creek, Washington, about half-hour north of Seattle.

Former Amazon staff stated the whole grocery technique has moved additional within the route of larger shops and clear of Pass marts.

The Pass department has turn into extra of a tech incubator. Its Simply Stroll Out generation is being examined at some Contemporary places, Entire Meals shops and full-size Pass Grocery shops, that have since been rebranded underneath the Contemporary label.

Closing month, Trade Insider reported that Amazon has thought to be promoting fuel at Pass comfort shops, in conjunction with lottery tickets and prescribed drugs. The corporate has reportedly said that promoting gas may deliver dangers, together with a possible war with its more than a few local weather tasks.

The way forward for Pass is cloudy. Got rid of from the grocery department, Pass falls underneath the bodily shops unit, controlled through Kumar, a former Pass worker stated. Kumar reviews to Hoggett, whilst Puerini has since retired from the corporate.

The Pass unit contains different sorts of Amazon shops such because the 4-star shops and bookstores, but in addition oversees building of the Simply Stroll Out generation and different merchandise such because the Amazon One contactless cost device.

"It is only a bunch of photographs on objective looking to determine it out," stated Scott Jacobson, a managing director at Madrona Project Team in Seattle and a former Amazon worker who helped release the Kindle. "It isn't transparent what the long run is but."

Only a novelty?

Pass first of all used to be saved break free the grocery department as a result of the point of interest used to be extra at the generation it used to be construction, the previous Pass worker stated.

However as Pass's operations enlarge, they begin to encroach on Amazon's different grocery property, doubtlessly growing the type of inner festival that the 2017 bake-off used to be meant to unravel.

What is transparent to folks throughout the grocery trade is that the funding and skill center of attention is on Contemporary. Then again, the tactic stays convoluted. Entire Meals has greater than 500 shops national. Amazon Contemporary has opened 38 shops within the U.S. and U.Ok. in lower than two years. And there are two dozen Pass comfort shops.

Jacobson stated that, in contrast to its e-commerce and cloud, Amazon's grocery trade is a novelty that hasn't created any actual differentiation in grocery to split it from the various competition.

"The issue with a novelty is that if it is not basically extra precious, then that is all it's — a novelty," Jacobson stated.

Traders have not loudly wondered the method but, however the macro surroundings is converting. Cash managers were rotating out of tech on inflation and rate of interest issues, sending Amazon's inventory in January to its worst per month drop since 2018. In line with a Wall Boulevard Magazine document this week, billionaire activist investor Dan Loeb, who is been including to his Amazon holdings, instructed traders on a personal name that he sees about $1 trillion in untapped worth on the corporate.

Like Bezos earlier than him, Jassy avoids the quarterly profits calls, so it used to be left as much as finance leader Brian Olsavsky to replace traders after fourth-quarter effects previous this month.

Groceries were not a large subject, however an analyst did ask Olsavsky about same-day supply and the way the corporate's investments are paying off.

"We be ok with the place we're," Olsavsky stated. With appreciate to looking to ship groceries in a single to 2 hours and Top applications in a single to 2 days, he stated, "We are proceeding to construct capability that allows us to hit the ones cutoffs."

— CNBC's Nate Rattner contributed to this tale.

WATCH: Cloud computing and promoting offset slowdown in e-commerce