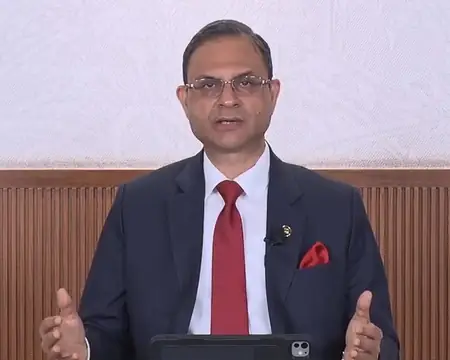

Mumbai’s financial landscape is set for a major shift as Reserve Bank of India Governor Sanjay Malhotra announced groundbreaking regulations on Friday. The RBI is rolling out new guidelines to ensure banks compensate customers swiftly for fraudulent transactions involving small amounts.

These measures build on the 2017 directives that already capped customer liability in unauthorized electronic banking cases. With technology transforming banking and payment systems at breakneck speed, the central bank has thoroughly reviewed those rules. The updated framework will specifically address compensation mechanisms for low-value frauds, with a draft set for public consultation soon.

Governor Malhotra emphasized the need for robust protections in an era of rising digital threats. Customers facing zero or limited liability scenarios will benefit from clearer timelines and processes. This proactive step aims to restore trust and minimize financial losses for everyday users.

Beyond fraud compensation, the RBI is cracking down on mis-selling of financial products by banks and non-banking financial companies (NBFCs). Such practices have severe repercussions for both consumers and institutions alike. To curb this, new stringent rules will mandate that third-party products sold at bank counters align perfectly with individual customer needs and risk appetites.

Draft instructions on advertising, marketing, and sales of these products will soon be open for stakeholder feedback. Additionally, the RBI is consolidating guidelines on recovery agents and loan recovery practices across all regulated entities. Currently fragmented rules will be streamlined into a unified draft, also up for public review shortly.

These comprehensive reforms signal the RBI’s commitment to a fairer, safer financial ecosystem. As digital banking proliferates, such measures are crucial to shield vulnerable customers while holding institutions accountable.