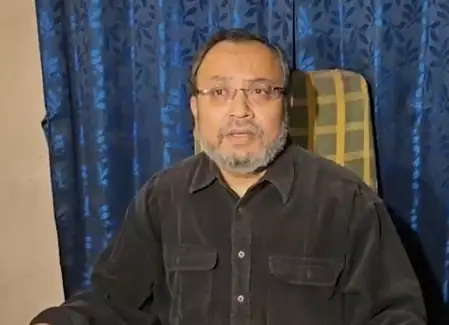

New Delhi’s economic circles are buzzing after Chief Economic Adviser V. Anant Nageswaran offered a measured take on the Indian rupee’s recent slide. Speaking at a press conference following the presentation of the Economic Survey 2025-26 by Finance Minister Nirmala Sitharaman, Nageswaran emphasized that the rupee’s weakness against the US dollar aligns perfectly with trends in other emerging market currencies.

‘These currencies are all navigating similar geopolitical headwinds,’ he noted, responding to queries from reporters. The rupee, which dipped 0.12 paise to 91.94 on Thursday, has been under pressure amid a broader dollar rally and rising gold import costs that are ballooning India’s import bill.

Despite short-term volatility, Nageswaran remains optimistic. He highlighted the economy’s robust fundamentals, pointing to structural reforms implemented by both central and state governments over the past 12-18 months. ‘If we stay the course and exports keep growing, investor perceptions of the rupee will strengthen,’ he asserted.

The CEA underscored that while some events are beyond control, sustained growth—potentially propelled by a strong manufacturing sector to 7.5-8%—will draw investors back. This exceeds the Economic Survey’s average growth projection of over 7%, signaling confidence in India’s trajectory.

Market watchers agree that macroeconomic stability, coupled with export momentum, could trigger a reassessment of the rupee’s value. For now, the currency’s dip reflects global patterns rather than domestic frailties, offering a silver lining amid the turbulence.