Adani Total Gas Limited (ATGL) announced robust financial results for the third quarter of fiscal year 2026, showcasing resilience amid challenging market conditions. The company’s net profit surged 11% year-on-year to ₹159 crore for the October-December period, up from ₹142.38 crore in the same quarter of the previous year. This growth underscores ATGL’s strategic prowess in the natural gas distribution sector.

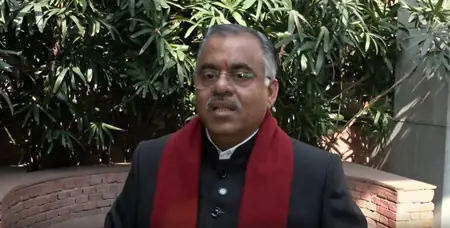

Revenue growth was equally impressive, climbing 17% to ₹1,631 crore from ₹1,397.35 crore last year. CEO and Executive Director Suresh P. Manglani highlighted the team’s strong performance, noting double-digit increases in volume, revenue, and EBITDA. ‘Our diverse sourcing strategy has been key in managing the gas basket efficiently despite low APM gas availability and high prices of RLNG linked to Henry Hub,’ Manglani stated.

Production volumes hit a new high with combined CNG and PNG sales reaching 289 MMSCM, a 12% rise from the prior year. The company expanded its network by adding 18 new CNG stations, bringing the total to 680, while domestic PNG connections grew to 10.5 lakh, including over 34,000 new households. Industrial and commercial connections also advanced, reaching 9,751 with 148 new customers.

ATGL’s joint venture, IOAGPL, mirrored this expansion with total production at 460 MMSCM, up 15%. Its CNG network now spans 1,120 stations after adding 41, serving over 40 lakh people daily through 12.5 lakh PNG domestic connections and 11,106 industrial-commercial links. The company also completed a 27,011 inch-km steel pipeline network across India.

EBITDA for the quarter stood at ₹314 crore, with nine-month cumulative at ₹919 crore. Despite a 41% cut in CNG APM allocation and high costs from alternative sources like new well gas and HPH T, ATGL ensured uninterrupted supply to all consumers, solidifying its position as a leader in India’s city gas distribution market.